Those who followed the cryptocurrency rates and the sentiment about bitcoin and other crypto’s last week, are already aware of it: it was another eventful week! There was not only a lot to report about the prices, there was also a lot going on in the field of regulation. For those who didn’t have time to keep an eye on the news this week, we made a short summary.

The price of bitcoin (BTC) managed to rise considerably at the beginning of last week, which made it look like the most dominant cryptocurrency was targeting the $13000. Even then, analysts warned against the chance of a correction. After a small bitcoin pullback, BTC managed to break through the $13000, where it seemed to keep trading above until Thursday. Within 12 hours the price then plummeted sharply, on Thursday morning it was just over $11500 and support seemed to have been found on $11000. In the weekend bitcoin consolidated and traded the crypto sideways, but yesterday it appeared that the bulls could not keep bitcoin above a number of important resistors. Bitcoin did find support on the $10000. The $10800 resistor is now being tested.

Although sentiment about bitcoin, with the drop in the price, seemed to deteriorate, analysts agree that a bitcoin price below $10000 is a good opportunity to invest and that the long term outlook is still positive. An analyst from the news website CCN points out that the 2016-2017 bull market saw as many as nine times a 30% pullback on its way to the record highs of late 2017.

There was also news about regulations. For example, the European Central Bank underlined its position on bitcoin by reporting on Twitter that bitcoin is not a currency, but a very volatile asset. The bank received a lot of criticism on Twitter. The Czech Republic, Sweden and Italy will lead the European Blockchain Partnership this year. The aim of the organisation is to develop a blockchain infrastructure for Europe.

Last but not least: US president Trump has spoken for the first time about bitcoin and other crypto-currencies. In a series of Twitter messages he stated that he was not a fan, because the digital assets would be based on thin air. Well-known names from the cryptocurrency community came up with a thorough response not much later. In line with this report, a new American bill appeared that could prevent large tech companies from issuing their own digital currency.

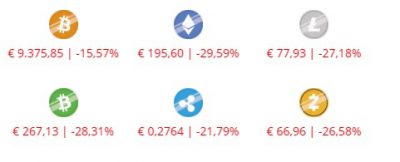

Price changes over the last 7 days