Last Monday’s morning, bitcoin (BTC) traded just above support around $9,800, but later that day, the most dominant cryptocurrency started to decline; and quite a bit. Support at $9,400 was broken and a low was formed at $8,159. The price then recovered somewhat and found support around $8,200. After this the bitcoin price climbed up again and on Thursday morning it traded just below $8,500. That same day bitcoin started another decline and ended up just below $8,000. Friday on Saturday BTC was able to rise a little bit again, so on Saturday morning bitcoin was trading just over $8,200. However, the bitcoin did not manage to rise convincingly above this level during the weekend. As a result, bitcoin started to decline again. On Monday, support held at $7,700 and the price started to rise again to above $8,000 on Tuesday. At the time of writing, bitcoin is trading around $8,260 on CoinMarketCap.

The question of why bitcoin made a dive soon arose. There is speculation that it has something to do with the expectations for the launch of Bakkt. It was expected that the volume on the platform would be substantial from the very beginning, but this was not the case. This would have led to less confidence in the most dominant cryptocurrency. In addition, a number of technical analysts claim that the $9,000 was an important support level that was breached and then there was a significant sell-off.

Then there was news about cryptocurrency exchange binance. The well-known exchange has received an accreditation from the International Organization for Standardization (ISO). This makes it one of the first cryptocurrency companies to receive such an accreditation. The exchange also announced that it has launched a new strike platform. This allows Binance customers to earn rewards by keeping certain Proof-of-Stake cryptocurrencies in their Binance wallet.

It was widely reported in the news: bitcoin’s hashrate suddenly dropped by more than 30%. An event that would indicate that the security of the Bitcoin network is in jeopardy. It was later suggested that the hashrate can only be estimated and the sharp drop is inherent in the Bitcoin network algorithm.

ING Chief Economist Mark Cliffemight said in a video that he expects central banks to issue digital currencies within two to three years. He said that the pressure on monetary authorities is growing as a result of projects such as Facebooks Libra.

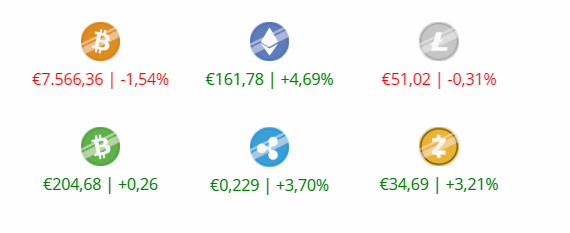

Price changes over the last 7 days